Trump's Argument For Fed To Lower Interest Rates Is 'Batshit Crazy'

The second quarter Gross Domestic Product report came in roughly in line with expectations. The surge in imports from the first quarter was reversed, which meant that imports were a large positive in the GDP accounts. That led to a 3.0 percent growth rate for the quarter. Averaged with the 0.5 percent decline from the first quarter, GDP grew at a 1.2 percent annual rate in the first half of the year.

That’s a sharp slowing from the 2.8 percent rate in 2024. Consumption in the first half grew at a 0.9 percent rate compared to the 3.4 percent increase in 2024. That’s not a very good picture.

Thankfully, the media largely got this one right and reported the GDP numbers for the first and second quarters together rather than taking the second quarter in isolation.

Also, inflation is going in the wrong direction. The annual rate of inflation in the core personal consumption expenditure deflator, the Federal Reserve’s preferred gauge, was 3.0 percent in the first half of the year.

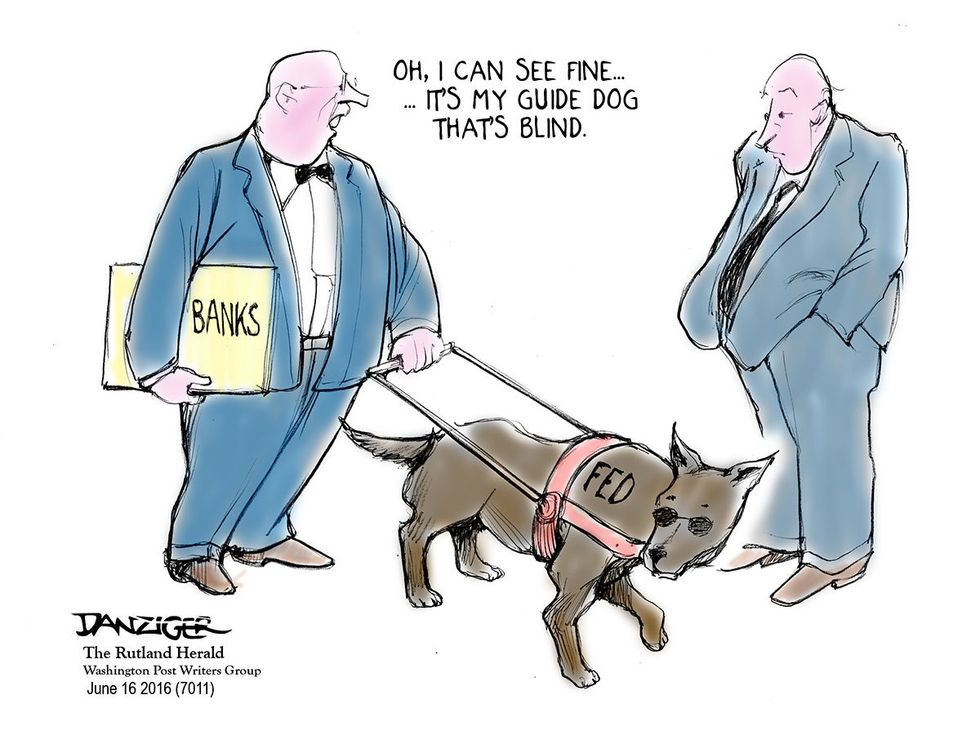

The higher inflation coupled with weak growth could make interest rate policy a tough call for the Fed. If it were to focus on inflation, it would keep rates constant, since lower rates could risk boosting inflation (a small risk in my view). If it focused on the economy’s weakness, as did two Trump appointees to the Fed’s Board of Governors, it would look to lower rates.

But there is a third argument coming from the Trump administration that people on Planet Earth would never consider: the Fed `should lower rates because the economy is strong.

Economics can get dull and technical, but this one is not a technical point. Lowering interest rates boost growth. It makes zero sense to lower rates if you believe the economy is booming as the Trumpers claim.

This is like telling someone you’re driving too fast, push the accelerator harder, or you better lose weight, have another piece of cake. If the economy were really booming, lowering interest rates would be the last thing the Fed should do, especially in a context where inflation is above its target.

But the Trump administration and its allies in Congress all have the lie down pat. They can stand up in front of a camera and with an entirely straight face say that the economy is booming, the Fed should lower interest rates.

Every administration is staffed by people who will argue the case for the president. But having followed politics closely for more than half a century, I have never seen people who were as accomplished liars as the Trump cabinet and their leading supporters.

On the lying front, Speaker Mike Johnson probably gets the gold medal. You can see him testifying to a jury:

“Yes, I shot the victim in cold blood after planning the killing for weeks. So therefore, I am completely innocent and should be acquitted.”

And the whole time he would have his silly smile, like he was telling his grandmother what he learned in school today.

Anyhow, down is not up, and day is not night. For now, it is still legal to talk truthfully about the economy and the idea that the Fed should lower interest rates because the economy is booming is batshit crazy. I know that saying that won’t get me a job in the Trump administration. We’ll see if it gets me arrested.